29.05.2018

European Commission approves State aid scheme for solar panels in rented residential buildings in Germany

(i) Introduction

The European Commission approved under EU State aid rules, in case SA.48327(1), the German scheme granting public support to landlords planning to install solar panels on the roof of apartment buildings. The electricity produced with these solar panels – per installation, with a capacity of less than 100 kW and with a limit of 500 Mw per year – is intended to supply the tenants of the buildings with electricity. The scheme budget is estimated at EUR 4 million per annum.

(ii) Aid scheme environmental rationale

The scheme allows tenants to actively participate in Germany’s transition to a low carbon, environmentally sustainable energy supply, in line with the European Union environmental objectives, and aims at ensuring that the share of renewable electricity supplied to German final customers rises to 40-45% by 2025, to 55-60% by 2035 and to 80% by 2050.

In this setting, German authorities further explained to the European Commission that for renewable electricity, without the financial support, the landlords would not install solar panels on rented buildings to supply electricity to their tenants because such investment would be either loss making or yield such a poor return that the investment would not worth the administrative and organizational burden that such projects imply. Henceforth, the aid measure makes the projects sufficiently attractive (in most parts of Germany) as the rate of return obtained with the support is in many cases higher than the rate of return obtained for injection of the electricity produced into the national grid.

(iii) Beneficiaries

The beneficiaries of the approved measure are producers of electricity from solar installations with a maximum installed capacity of 100 kW. The installation concerned must be located in a residential building and the support is granted only for electricity that: (a) is supplied to a final customer; (b) is consumed in the building in which the electricity is produced or in residential or secondary buildings that are in the immediate vicinity of the building in which the installation is located – for this purpose, residential buildings were defined in the scheme as buildings that are used at least 40% (of their surface) for residential purposes; and (c) does not circulate though the public grid.

(iv) Reasoning of the funding measure

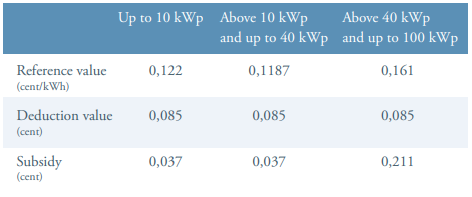

The financial support is paid to the beneficiaries as a premium calculated as the difference between the reference value applicable when the installation enters into operation and 8.5 cents/kWh. This premium is only granted on the electricity produced by the photovoltaic installation and consumed by the tenants. Excess electricity produced by the installation, not consumed by the tenants, and consequently injected into the national grid remains eligible for support for electricity injected into the grid under an autonomous aid scheme previously approved by the Commission (2).

The decision specifies the “reference value” for subsidised solar installations entering into operation, based on 2017 data, as follows:

To have the aid scheme approved by the Commission, German authorities also had to exhaustively describe the economics of the financial support and submitted an extensive study on the subject, under which the decision to invest into a solar installation on rented buildings depends on: (a) the costs of the installation (investment and maintenance), the costs of the adaptation of the network needed to connect the PV installation to the elec tricity system of the building, the cost of installing the metering equipment and the costs of managing the electricity contract with the tenant and the costs of supplying the tenant with electricity from the grid for the part of his consumption that is not covered by the solar installation; (b) the revenues that the landlord can obtain from supplying the electricity to his tenants. Albeit, such revenues will depend on both the quantity of electricity sold, the extent to which the electricity produced from the installation is consumed by the tenants and the price per kWh that can be agreed between the landlord and the tenant. In general, the tenant will conclude a contract with the landlord for the supply of electricity only if the price is not higher than the best offer that can be obtained from an electricity supplier on a market basis; (c) the revenues that the landlord can obtain from injecting unconsumed electricity into the grid; and (d) the level of national surcharges imposed on electricity supplied to the tenant.

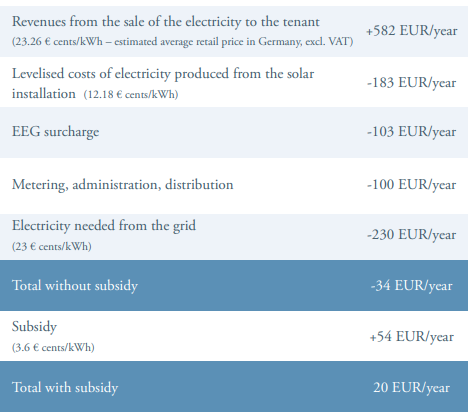

The decision includes an in-depth economic review of the data disclosed by German authorities on the themes described above. In this context, the authorities further provided to the European Commission a simplified calculation of the project costs and revenues for a typical household (consumption of 2.500 kWh/year,60% of the consumption covered by the solar installation and the rest needs to be covered by the grid), as follows:

The financial support is granted to beneficiaries for a period of 20 years, which corresponds to the depreciation period of the installation. The support is funded via a surcharge on electricity paid by network operators and certain categories of consumers.

(v) Validation of the aid scheme

The Commission assessed and approved the scheme under Article 107(3)(c) Treaty on the Functioning of the European Union (‘aid to facilitate the development of certain economic activities …, where such aid does not adversely affect trading conditions to an extent contrary to the common interest’) taking into account the 2014 Energy and Environmental State aid Guidelines (3), specifically the section on Aid to energy from renewable sources. As such, the Commission under an extensive and detailed reasoning considered that the following cumulative conditions were met by the aid scheme: (a) contribution to a well-defined objective of common interest, as the aid measure aims at an objective of common interest; (b) need for State intervention, as the measure is targeted towards a situation where aid can bring about a material improvement that the market alone cannot deliver, by remedying a well-defined market failure; (c) appropriateness of the aid measure, the aid measure is an appropriate policy instrument to address an objective of common interest of the European Union; (d) incentive effect, the aid changes the behaviour of the entity concerned in such a way that it engages in additional activity which it would not carry out without the aid or which it would carry out in a restricted or different manner; (e) proportionality of the aid, the aid amount is limited to the minimum needed to incentivise the additional investment or activity in the area concerned; (f) avoidance of undue negative effects on competition and trade between Member States, as the negative effects of the aid measure are sufficiently limited, so that the overall balance of the measure is positive; and (g) transparency of aid, as Member States, the Commission, economic operators, and the public, have easy access to all relevant acts and to pertinent information about the aid awarded under the approved scheme.

The methodical German state aid scheme approved by the Commission has as beneficiaries producers of electricity from solar installations located in rented residential buildings with a maximum installed capacity of 100 kW, with a cap of 500 Mw per year. Moreover, the requirements of the scheme, imply that the photovoltaic installations concerned must be located in a residential building; the support is granted only for electricity that is supplied to a final customer, acting as a tenant the energy is consumed in the building in which the electricity is produced or in residential or secondary buildings that are in the immediate vicinity of the building in which the installation is located; and the produced electricity does not circulate through the public grid.

_______________________________________

(1) Public version of the Decision published on 8 February 2018, accessed at http://ec.europa.eu/competition/elojade/isef/case_details.cfm?proc_code=3_SA_48327 [consulted on 29 May 2018].

(2) The initial support scheme for the promotion of the production of renewable electricity has been approved by the Commission by decision of 23 July 2014 in State aid file SA.38632 (2014/N) – Germany – EEG 2014 – Reform of the Renewable Energy Law and by decision of 20 December 2016 in State aid file SA.45461 (2016/N) – Germany – EEG 2017 – Reform of the Renewable Energy Law.

(3) Published in the EU Official Journal, C 200, 28.6.2014, pp. 1–55.